Eliminating Estate Tax On Inherited Wealth Would Increase Deficits And Inequality Center On Budget And Policy Priorities

When do you pay inheritance tax The tax is not automatically triggered on an estate worth more than 325000. If the person who dies leaves their home to their children or grandchildren but no other family like a niece of nephew then the threshold goes up to 500000. It has been reported he could cut the headline rate of inheritance tax - the tax on the estate property money and possessions of someone whos died - from 40 to 20. What It Is How to Avoid It Inheritance tax is different from estate tax and whether you pay might come down to your state. In fact just six states have an inheritance tax as of 2023 and the taxation depends on the state in which the deceased lived or owned property the value of the inheritance and the..

ThinkSPAIN Team 26092023 IN LIGHT of the news that four regions have axed inheritance and gift tax either. In this article you will discover how the Spanish inheritance tax system works including the legal background who is. Spanish inheritance tax operates with a system of allowances meaning that heirs in certain..

Where a natural person who is not resident in Spain receives an inheritance or a gift they have to file. Calculating inheritance tax in Spain involves several stages and can vary depending on a number of local..

Inheritance Tax in Austria Obligation to report inheritances and gifts Inheritances or gifts are also observed by the tax office after this point The extension of the real estate transfer tax. Is there an inheritance tax in Austria Since August 1st 2008 there has been no inheritance tax in Austria But there is a real estate transfer tax of 35 percent if someone inherits. Inheritance law in Austria Inheritance law on pensions in Austria In Austria there are three types of benefits that you can receive in the event. There is no inheritance or gift tax in Austria so there are no requirements for planning mechanisms for the tax-free transfer of assets to younger generations However there is a special notification. There is currently no inheritance tax in Austria but a transfer tax of 35 2 for close relatives is levied on the transfer of the property to the successor..

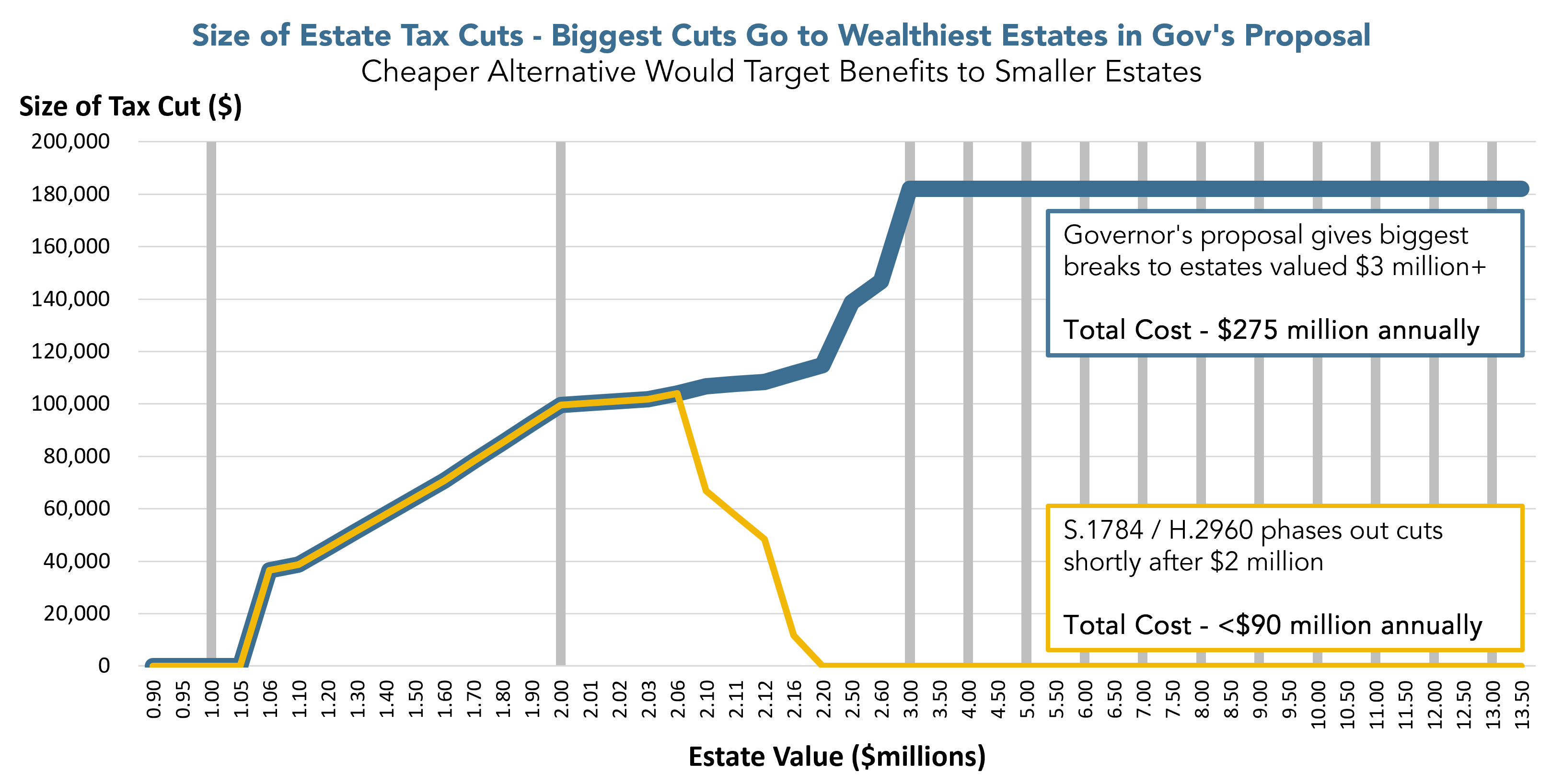

Governor S Estate Tax Plan Is Costly And Gives Biggest Breaks To Largest Estates Better Options Exist Mass Budget And Policy Center

Comments